New Survey Explores Tax Reform's Effect on Charitable Giving

John Wilson

Published: 10/11/2018

The Charitable Giving Coalition’s (CGC) member organizations, including AHP, conducted a survey in July 2018 to gauge the initial effect of the Tax Cut and Jobs Act, passed by Congress in December 2017. The Act doubled the standard deduction for U.S. tax filers, meaning that fewer are likely to itemize, which reduces one incentive for charitable giving.

In real terms, more than 30 million taxpayers will no longer be able to deduct their charitable gifts, which will translate to a decline of more than $13 billion in charitable contributions annually. This decline represents between 4% and 6.5% of contributions, according to studies by Lilly Family School of Philanthropy at Indiana University and Tax Policy Center.

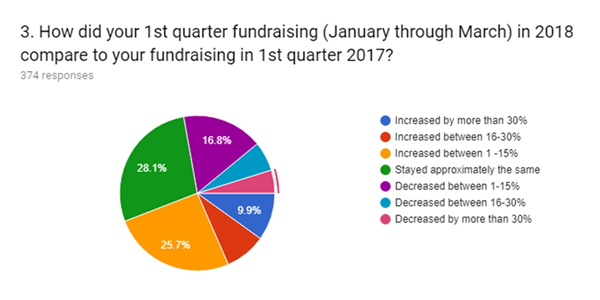

According to the CGC survey, 45.5% of respondent organizations saw an increase in charitable giving in the first quarter of 2018 (January through March), compared to the same period in 2017. Fundraising returns decreased for 26.4% of survey respondents, while 28.1% maintained the same level of performance as in Q1 2017.

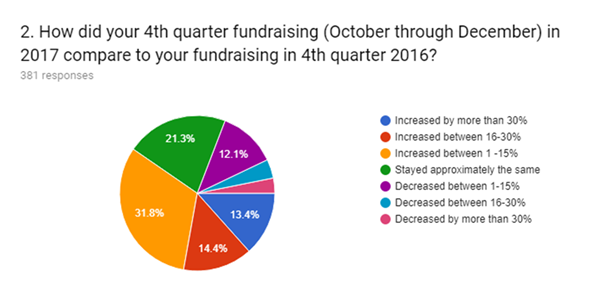

These numbers compare unfavorably to performance in the fourth quarter of 2017 (October through December), in which 59.6% of survey respondents saw increased fundraising performance compared to the same period in 2016. Fundraising returns decreased for just 19.1% of respondents, while 21.3% maintained the same level of performance as in Q4 2016.

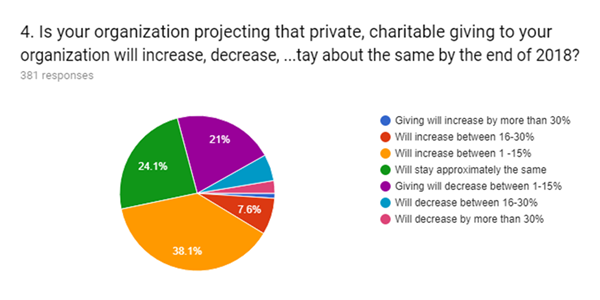

Survey participants are more pessimistic as they look forward to the rest of 2018. Nearly thirty percent (29.2%) project their overall fundraising for 2018 will decrease, while 24.1% expect their fundraising income to remain steady and 46.7% expect it to increase.

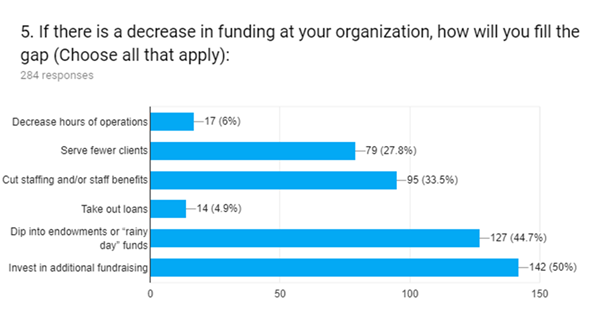

Half of the survey respondents would invest in additional fundraising efforts in the event of a decrease in funding at their organization. That’s a good strategy, according to the 2017 AHP Report on Giving, US, which shows organizations receive a $4.06 return for every dollar invested in philanthropy.

However, other options for filling the gap are more troubling. Forty-four percent would dip into endowment funds, 33.5% would cut staffing or benefits and 27% would serve fewer clients, all choices that would have a negative impact on the organization’s short- or long-term impact and viability.

Thirty percent of survey respondents indicated that donors have expressed confusion or uncertainty about their giving due to the new tax law, while 24.7% of respondents said that some of their donors may delay giving this year or even into 2019 because of changes in the tax law.

The Charitable Giving Coalition will soon conduct a second survey to obtain data about fundraising performance in the second quarter of 2018, which should cast further light on the effect tax reform is having on the nonprofit sector. As AHP and its advocacy partners monitor the effect of tax reform, data like this can help demonstrate to lawmakers the importance of addressing this issue created by the 2017 legislation.

AHP continues to support a universal charitable deduction, which would recoup the losses from the expanded standard deduction and promote charitable giving by allowing all taxpayers to deduct their contributions.